Regulatory Burden Breakdown for 2018: Compliance Statistics & Best Practices

- October 31, 2018

- Quantivate

Regulatory change shows no signs of slowing down — which means the cost of compliance for organizations continues to climb.

Competitive Enterprise Institute’s regulatory snapshot for 2018 found that annual regulatory costs in the U.S. add up to approximately $1.9 trillion. One estimate projects that organizations of all sizes spend, on average, just under $10,000 per employee annually in regulatory costs.

In order to avoid unnecessary costs or fines, businesses need to keep up with regulatory change and take appropriate action to stay compliant. But that’s no easy task. In 2017, more than 900 regulatory agencies issued a combined 200+ regulatory updates every day, on average.

Counting the Costs

The financial services industry has some of the highest regulatory costs. One survey reports that the average cost of compliance for financial services companies nearly doubled between 2011 and 2017, from $16 million to $30.9 million. That’s significantly higher than the $5.47 million average for organizations across all industries. The costs of non-compliance are even greater, typically about triple that of staying compliant.

Credit Union National Association (CUNA) confirmed the skyrocketing costs with its own study in 2017, which found that credit unions alone face an estimated $6.1 billion in combined annual regulatory costs, or about 15% of operating expenses devoted to regulatory burden — an $800 million increase in just two years.

Given this complex and costly regulatory landscape, how can organizations cope with regulatory burden and avoid the consequences of non-compliance?

As Harvard Business Review puts it, “better compliance measurement leads to better compliance management.”

It’s obvious to us that the value of compliance must be made clearer to company leaders and employees alike. The answer, we believe, lies in better measurement. At its core, the idea is as simple as it is crucial: Firms cannot design effective compliance programs without effective measurement tools. For many firms, appropriate measurement can spur the creation of leaner and ultimately more-effective compliance programs. Put simply, better compliance measurement leads to better compliance management.

But what does better measurement and management look like?

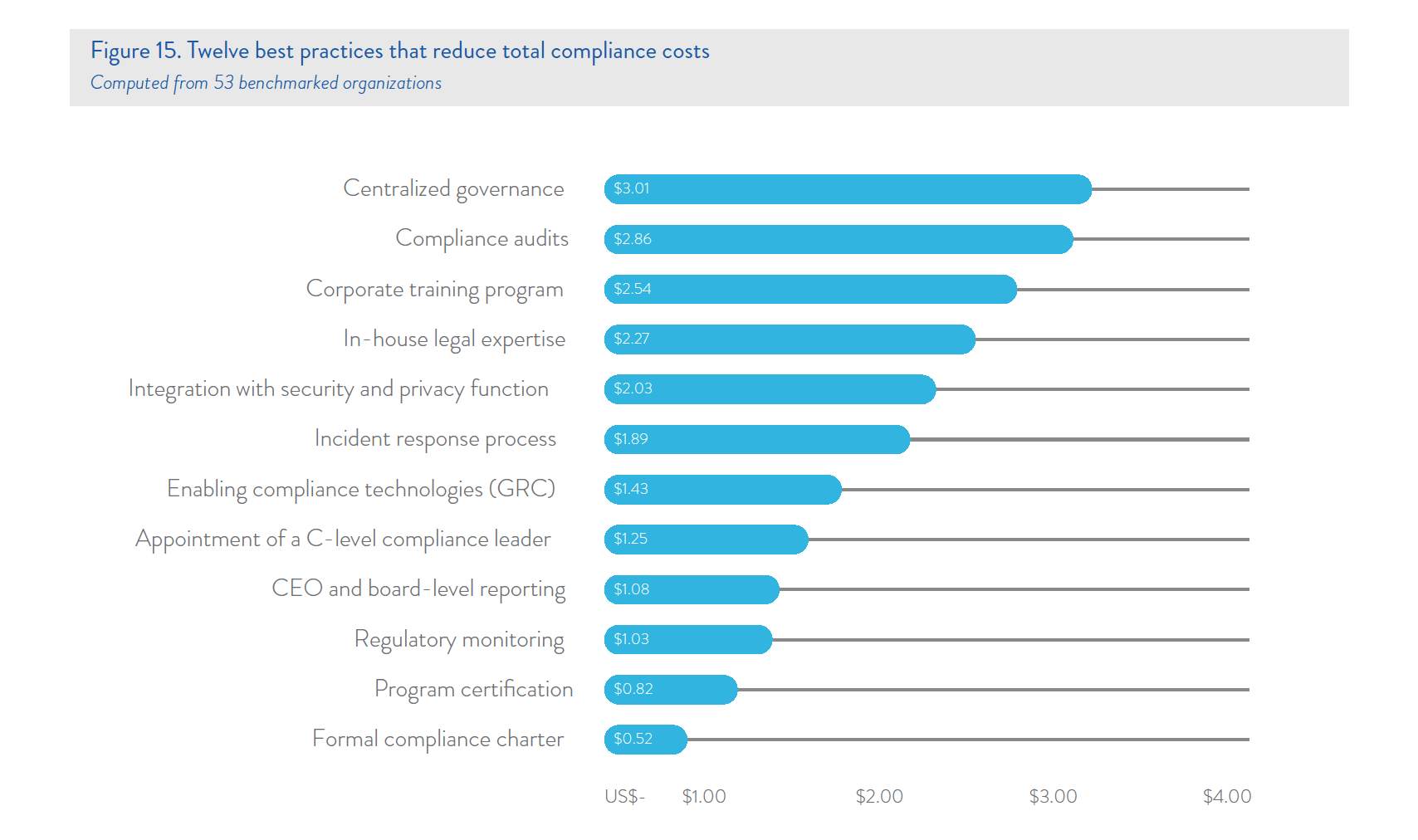

In a recent benchmark study, “centralized governance” ranked first among the top best practices for reducing compliance costs, saving an estimated $3 million in total costs across the 50+ organizations surveyed. Other cost-saving best practices included:

- Compliance audits = $2.86 million in savings

- Integration with security and privacy functions = $2.03 million in savings

- Incident response processes = $1.89 million in savings

- Enabling compliance technology = $1.43 million in savings

- Regulatory monitoring = $1.02 million in savings

What if you could combine all those best practices in one compliance management platform?

Quantivate Regulatory Compliance Management Software

The benefits of measuring and managing compliance are clear. But many organizations make do with decentralized, disconnected tools and software, which increases risk.

Quantivate’s Regulatory Compliance Management Software offers built-in best practices, including:

- Centralized governance

- Real-time compliance status tracking

- Automatic alerts for regulatory changes

- Integration with other risk management activities (vendor management, IT risk management, etc.)

- Risk assessment and audit tools

- Compliance testing templates and reporting tools

As the costs of compliance and the risks of non-compliance continue to grow, your organization needs an efficient way to cope with regulatory burden and improve compliance.

Learn more about how we can help and see our software in action by scheduling a personalized demo.