Governing the Third-Party Risk Management Lifecycle

- September 2, 2022

- Quantivate

What Is Third-Party Risk Management?

Third-party risk management (TPRM) involves creating a framework of policies, processes, and tools to manage and monitor the risk arising from vendors and other external business relationships.

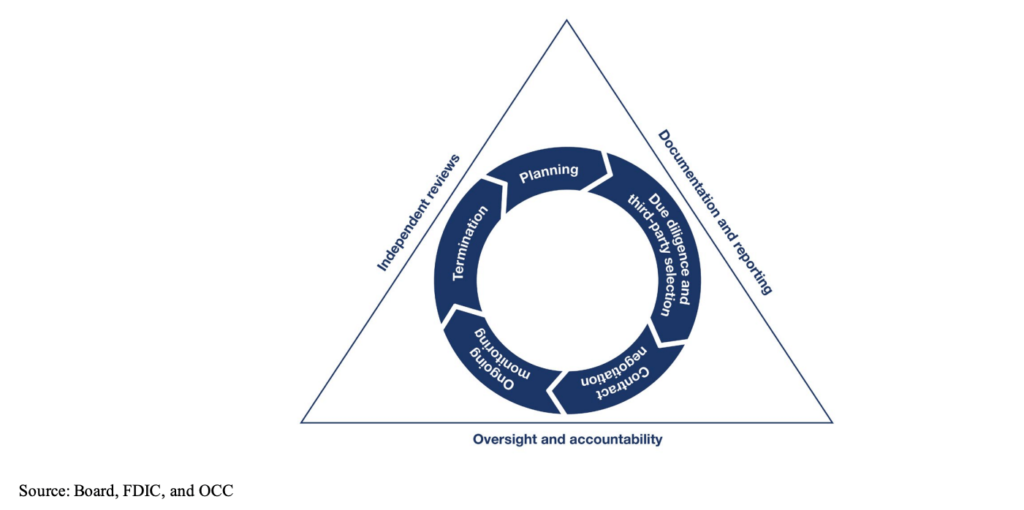

Proposed regulatory guidance on managing third-party risk from the FDIC, Federal Reserve Board, and OCC defines the third-party risk management lifecycle for financial institutions as including the following stages:

- Planning: Developing a plan that outlines the banking organization’s strategy, identifies the inherent risks of the activity with the third party, and details how the banking organization will identify, assess, select, and oversee the third party

- Due Diligence and Third-Party Selection: Performing proper due diligence in selecting a third party that assesses the organization’s ability to perform the activity as expected; adhere to policies; comply with all applicable laws, regulations, and requirements; and operate in a safe and sound manner

- Contract Negotiation: Negotiating written contracts that articulate the rights and responsibilities of all parties and periodically reviewing existing contracts to ensure they continue to address pertinent risk controls and legal protections

- Oversight and Accountability: Having the board of directors and management oversee the banking organization’s risk management processes, maintaining documentation and reporting for oversight accountability, and engaging in independent reviews

- Ongoing Monitoring: Monitoring third party’s activities and performance throughout the duration of the relationship

- Termination: Developing contingency plans for terminating the relationship in an effective manner

Benefits and Risks of Relying on Third Parties

The guidance acknowledges that third-party relationships can provide “significant advantages” in supporting operational efficiency, serving consumers, and remaining competitive.

“As the banking industry becomes more complex and technologically driven, banking organizations are forming more numerous and more complex relationships with other entities to remain competitive, expand operations, and help meet customer needs.”

But the agencies also warn that third parties can present challenges such as:

- Reduced control of business activities

- Introduction of new risks or increasing existing risks

- Greater complexity due to ineffective risk management or inferior third-party performance

- Heightened risk management considerations in addressing consumer protection, information security, and other operational risks

Related Reading | Understanding the Third-Party Risk Landscape >

Evaluating Your Third-Party Risk Management Lifecycle

Third parties bring unpredictable challenges to organizations of all sizes and must be met with a strategy designed to address uncertainty. Successful vendor risk management can’t follow a “one-and-done” approach, but must be flexible and continuous through the lifetime of a third-party relationship.

However, establishing and sustaining healthy and secure vendor relationships doesn’t end after a certain number of steps. Re-assessing risks, controls, criticality, performance levels, and other factors keeps your TPRM program adaptable to changes.

And no matter how your management program is structured, regulators expect financial institutions to adopt effective processes that are “commensurate with the level of risk and complexity of their third-party relationships.”

Does your organization have the capabilities it needs to assess third-party risk and maintain an effective, compliant vendor management program? Learn more about developing a framework for the complete third-party risk management lifecycle in the Vendor Management Best Practices Playbook.

Then discover how Quantivate helps financial institutions mature their vendor management capabilities: