Delivering Comprehensive ESG Initiatives

- June 24, 2022

- Quantivate

More than a hot topic among business leaders, ESG initiatives provide a comprehensive way for organizations to report and deliver on their commitments in the areas of environmental, social, and corporate governance.

Regulators, investors, consumers, and employees alike are increasingly focused on the ethics and sustainability of organizations’ business practices.

Stakeholders seeking ESG information want more than “commitments” and “drives”; they’re looking for comparable data and evidence of action on the organization’s part. This requires an integrated strategy and reporting capabilities, as well as making ESG an integral part of your institution’s DNA.

Preparing for an Uncertain Future of ESG Regulation

From a regulatory perspective, financial services firms still face many unknowns. “We’re sitting at a crossroads today—a pretty big one,” Daniela Arias told the ABA Banking Journal.

Arias, audit senior manager for ESG services at Crowe, explained that “U.S. financial institutions are dealing with a lot of uncertainty around ESG regulation. We don’t really know the extent to which regulation is going to change the corporate reporting landscape and the related compliance issues. We also don’t know the effect that it’s going to have on the way that the financial services industry operates.”

But what is certain is that regulatory guidance is coming. The SEC and other regulators have signaled their intention to release guidance on ESG disclosures and reporting, particularly in the area of climate risk.

Getting Started with ESG Management

In this “new era of corporate morality,” Bank Director reports, “a growing number of banks are taking ethical behavior one step further through voluntary adoption of formal environmental, social and governance (ESG) programs that target objectives well beyond simply making money for their owners. Issues that typically fall within an ESG framework include climate change, waste and pollution, employee relations, racial equity, executive compensation and board diversity.”

Developing ESG policies, data collection and management processes, and risk and compliance frameworks that address these issues — before regulatory mandates require it — is a strategic opportunity for the financial services industry to approach ESG initiatives as a source of long-term value creation.

Even for institutions that don’t have formal structures for managing and reporting on ESG, leveraging existing risk management functions can be a place to start.

“For banks that do not have a dedicated ESG or sustainability office, ERM can step in to fill in the void,” recommends a former corporate governance officer at the International Finance Corporation.

“ERM brings value by aligning all the pieces of the ESG puzzle and developing a holistic and cohesive approach. Doing so requires collaboration across three lines and establishing a productive partnership with peer functions.”

Related Reading | How to Make Risk-Based Decisions: Applying the Three Lines Model for Maximum Business Value >

Utilizing existing enterprise risk management frameworks and technology can help financial institutions take a proactive stance on ESG and prepare to respond to an evolving risk and regulatory landscape.

Developing Balanced ESG Initiatives

Some organizations may be inclined to focus their efforts on one dimension of ESG, but it’s important to recognize the interconnected nature of ESG issues and risks. Environmental or social initiatives won’t get very far without effective governance.

However, the “G” in ESG tends to receive less attention than the environmental and social pillars, despite its critical role in any ESG strategy. Simply put, corporate governance refers to organizational processes for making and implementing decisions, complying with laws/regulations, and meeting stakeholder requirements. Its domain encompasses internal practices, procedures, controls, and board/management structures.

Governance: Bringing It All Together With the G in ESG

While one side of the governance coin is concerned with oversight, big-picture strategy, and organizational vision, it also must be rooted in the day-to-day realities of operational resilience, compliance, and risk management.

Institutions that have a governance, risk, and compliance (GRC) program in place will find it easier to incorporate ESG management processes and reporting. An established GRC framework offers a foundation to build on for risk assessment, compliance tracking, data management and analytics, and other capabilities that will be necessary for successful ESG initiatives.

Setting ESG Priorities

A governance best practices survey found that 82% of bank board directors and CEOs “believe that measuring and understanding where banks stand on environmental, social and governance issues is important for at least some financial institutions.” However, far fewer prioritize ESG oversight in practice: less than half (44%) of respondents reported that their board and management team has developed or has been working to develop an ESG strategy for their bank.

This disconnect between acknowledging ESG’s importance and acting on it may prove problematic for financial institutions that fail to prepare for ongoing developments in regulatory scrutiny and consumer sentiment.

So where should financial institutions begin? One approach is to identify the ESG issues that matter to your organization.

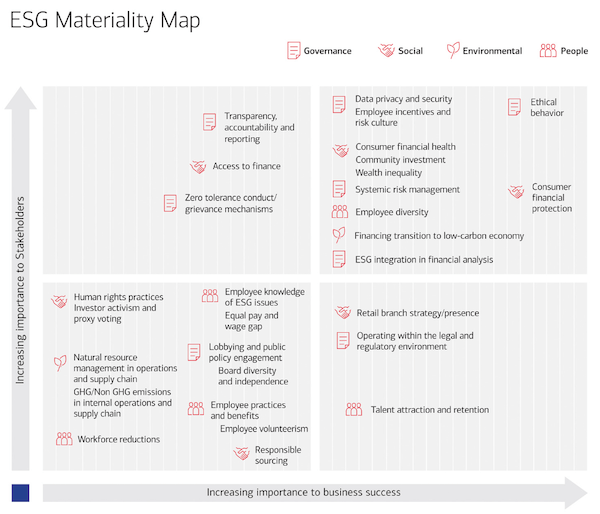

Bank of America, for example, developed an ESG Materiality Assessment to identify relevant issues, ranked by importance to core business success and external stakeholders.

Source: Bank of America

The assessment resulted in 29 ESG issues to guide the bank’s reporting and disclosure practices. A sampling of the wide-ranging inventory includes:

- Transparency, accountability, and reporting

- Data privacy and security

- Ethical behavior

- Consumer financial health

- Systemic risk management

- Employee incentives and risk culture

- Employee diversity

- Natural resource management in operation and supply chain

- Operating within the legal and regulatory environment

- Talent attraction and retention

Implementing ESG initiatives to govern your organization’s practices in complex areas like these may seem daunting. But by leveraging existing GRC frameworks and tools, financial institutions can get in front of the tide of change and also start building a holistic approach to ESG risks and impacts that will serve them well regardless of what regulatory requirements materialize in the future.

Read Next | Proving the Value of a Bank ERM Program [Series] >