Proving the Value of a Bank ERM Program [Part 2]

- October 1, 2020

- Quantivate

The Business Value of ERM Technology for Banks

In Part 1 of this series, we explored how banks can build a business value case for enterprise risk management (ERM). For many institutions, extracting that value will be difficult without the digital transformation that a technology-enabled ERM program facilitates.

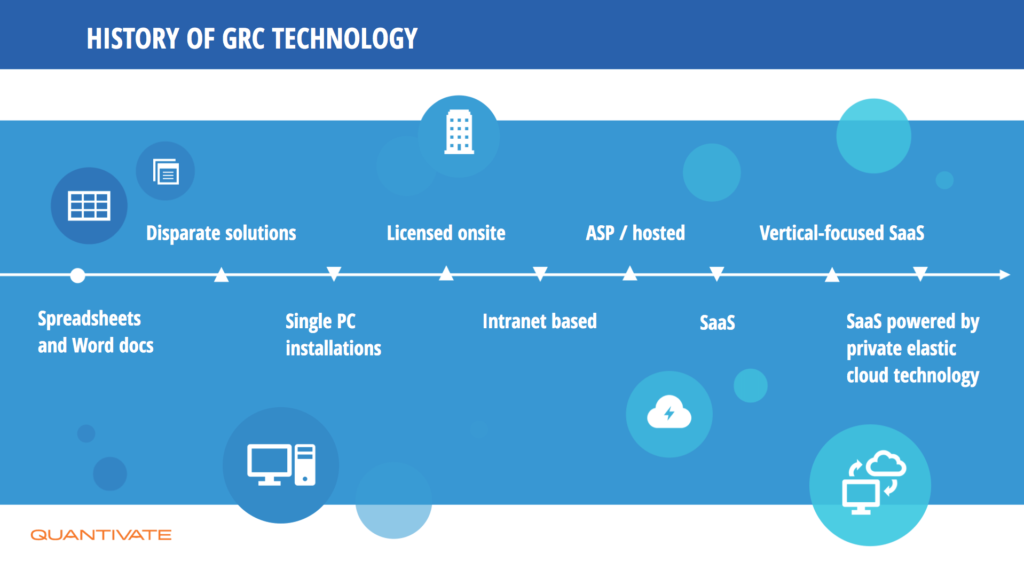

Technology for governance, risk, and compliance (GRC) management has come a long way — from spreadsheets and office software, to cobbled-together solutions that don’t connect across processes and risk categories, to cloud-based software designed to manage specific risk verticals like third parties or business continuity.

Many banks find that managing risk in today’s business environment requires flexible, integrated tools, and recent years have seen a shift to software-as-a-service (SaaS) solutions that offer a scalable platform for enterprise risk management.

Benefits of Investing in Integrated ERM Technology for Banks

A truly enterprise-wide approach to risk management is next to impossible to achieve and maintain when risk and compliance activities are conducted by email, analyzed in spreadsheets, and reported on using time-consuming manual processes.

Investing in ERM technology for banks that streamlines and automates risk management processes, on the other hand, provides significant opportunities for improving program oversight, maturity, and cost-effectiveness.

1. Accelerate Time to Value

In the past, implementing ERM software involved time-consuming installation and implementation processes that could take months or even years before your ERM program was fully operational and providing strategic value. Today’s SaaS solutions can have you up and running with built-in risk management best practices and making progress toward program maturity in a matter of weeks.

2. Break Down Silos

It’s challenging to aggregate risk data and extract trends and insights when every business unit defines, assesses, and manages risk differently. An ERM solution that centralizes and standardizes risk management in one integrated system offers a single source of truth for all ERM data, documentation, and tasks. This not only reduces duplication and error, but also improves visibility and accountability across all of your bank’s GRC initiatives.

3. Reduce Infrastructure, Licensing, and Labor Costs

Managing ERM through a single technology platform frequently reduces both the number of tools and the number of employees appointed to risk and compliance. Instead of using multiple pieces of software for various management tasks or different risk verticals, banks get the most value out of a flexible system that can meet their immediate risk management needs and grow with them in the long-term.

Plus, for banks that choose a comprehensive solution, risk managers and other GRC practitioners can access tools for task management and notifications, data and documentation, assessment, and reporting in one location — significantly reducing manual labor.

Get the Most Value Out of Your Bank ERM Program

Quantivate risk management solutions pair integrated technology with industry-specific best practices, equipping financial institutions with the tools and support they need to make strategic decisions around risk and compliance. Whether your bank is building a formal ERM program from scratch or looking to mature your approach to risk management with advanced capabilities, Quantivate GRC solutions for banks and ERM services can help your institution maximize the value of your program.

Take it from some of Quantivate’s customers in the banking industry:

“Having been a previous customer, and given my experience with Quantivate’s level of quality, service, customer support, and product ease, I knew it would be the software our growing bank could count on to help us implement a strong ERM program. Not only were the reports to the board helpful, but the examiners were also quite impressed with the level of ERM knowledge the board had about each area.”

“We knew that we needed to progress the maturity of our program and wanted to take a more holistic and integrated approach to ERM instead of moving forward with our current silos. We quickly realized that the integration of the software among modules with shared data would help us achieve this.”

Download the Quantivate ERM Software Datasheet or get in touch to learn more about ERM technology for banks and other integrated GRC solutions.